From blight to stability

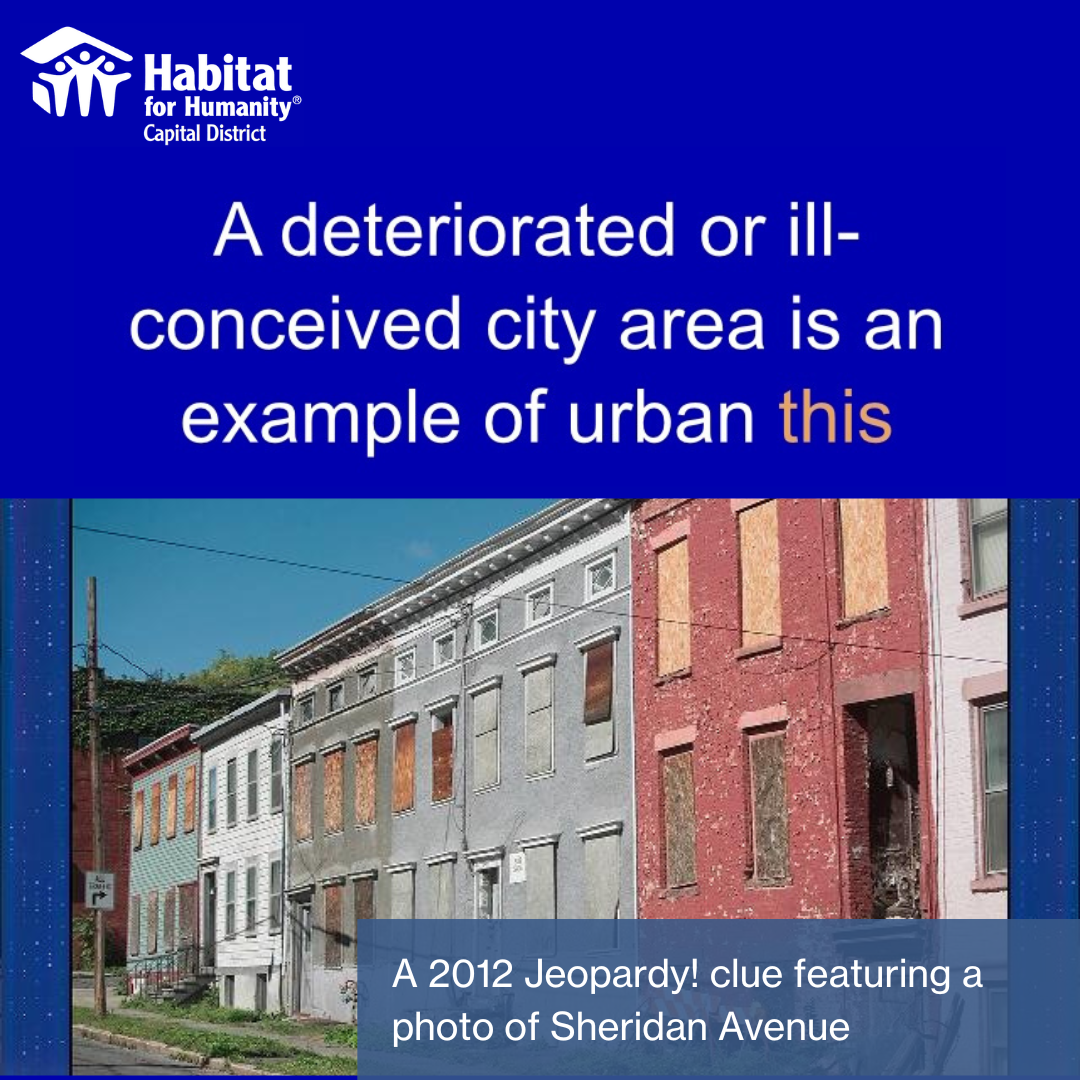

Habitat for Humanity Capital District announces the completion of three new affordable homes on Sheridan Avenue, the site of a 2012 Jeopardy! game show question about “urban blight.”

In 2012, the block of Sheridan Avenue east of South Swan St was featured on Jeopardy! as an example of urban blight. In the years since that episode aired, Habitat for Humanity has built 45 new homes in Albany’s Sheridan Hollow neighborhood, which represents more than $10 million of investment.

Today, Habitat announces the completion of three new affordable homes on the site of the Jeopardy! game show reference feature on urban blight. All three homes have been purchased by first-time local homebuyers.

These homes represent the first three homes to be completed under Habitat’s joint 100 in 5 initiative with the Albany County Land Bank to develop 100 new affordable homes in the next five years. Three down, 97 to go!

Sheridan Avenue, BEFORE (facing west)

Sheridan Avenue, AFTER (facing west)

The numbers

The new single-family townhomes each feature 3 – 4 bedrooms, 1.5 bathrooms, an open first floor layout and a full basement. Construction of the three Sheridan Avenue homes costs an estimated $280,000 each, for a total investment of approximately $840,000. Habitat uses subsidies to lower the purchase price so that it is affordable to first-time, lower-income buyers. Each house therefore required at least $135,000 in subsidy in order to build and sell affordably.

These numbers are representative of the reality in Albany’s historically-redlined neighborhoods, where low property values are a stubborn legacy of decades of housing discrimination. The appraisal gap – or development gap – is a major obstacle to building more affordable homeownership opportunities in our city.

Environmental sustainability

All homes meet the strict energy efficiency requirements established by EPA's ENERGY STAR Residential New Construction program. The houses are also National Green Building Standard™ certified. To earn certification to the National Green Building Standards™, a home must meet rigorous criteria in six categories: Lot & Site Development; Resource Efficiency; Energy Efficiency; Water Efficiency; Indoor Environmental Quality; and Homeowner Education.

Sheridan Avenue, BEFORE (facing east)

Sheridan Avenue, AFTER (facing east)

Financial sustainability

Habitat homebuyers have access to an exclusive Habitat/SONYMA mortgage product that saves owners an average of $37,590 in interest payments over 30-year period, compared to a conventional loan. This SONYMA product also saves an estimated $6,750 in down payment costs. Habitat homes are also sustainable to maintain in the long-term. Habitat’s program offers lower-risk homeownership opportunities, because Habitat takes on the risks of construction, not the first-time homebuyer. All homebuyers completed pre-purchase education through the Affordable Housing Partnership.

The project is funded in part by grants from the Touhey Homeownership Foundation, Enterprise Community Partners and the Albany Community Development Agency.

Project financing comes from the Community Loan Fund of the Capital Region.

Habitat acquired the three vacant properties from the Albany Community Development Agency, the Albany County Land Bank and Housing Visions.

Thanks to a permanent affordability model, these one-time investments will be paid forward to future generations.

Community control

These homes mark Habitat's first permanently affordable homes, developed in partnership with the Albany Community Land Trust (ACLT). ACLT is a nonprofit organization governed by a board of ACLT residents, neighbors and community representatives. Community Land Trusts help build both individual and community assets through shared equity homeownership, which enables CLT homes to remain permanently affordable and for community land to remain in community control.

Community land trusts are a proven model for communities to control land and development.

Habitat/ACLT homeowners build three kinds of equity:

“Pocket equity”, or the monthly savings of having an affordable place to live

“Earned equity”, as a result of paying down the mortgage principal each month

“Appreciated equity” when the home’s value increases over time. In exchange for accessing the $135,000 subsidy and additional savings, Habitat/ACLT homeowners agree to pay a portion of these benefits forward.

ACLT uses a resale formula that provides sellers with a share of a home's appreciation, plus what they have paid toward their mortgage principal, down payment and improvements. Community land trusts were first formed to prevent the displacement of Black sharecroppers in the rural South and have been used throughout the country to advance racial equity in housing.

With permanent affordability, homes can become not just an individual wealth-building asset but also a collective community asset, ensuring that the investments being made truly belong to the neighborhood and the residents that live there.